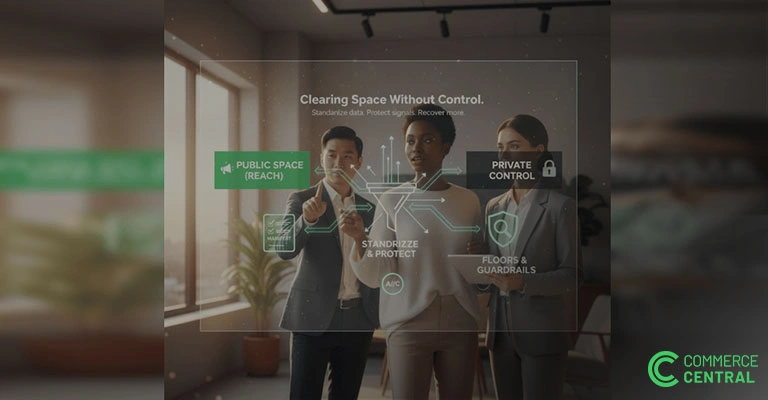

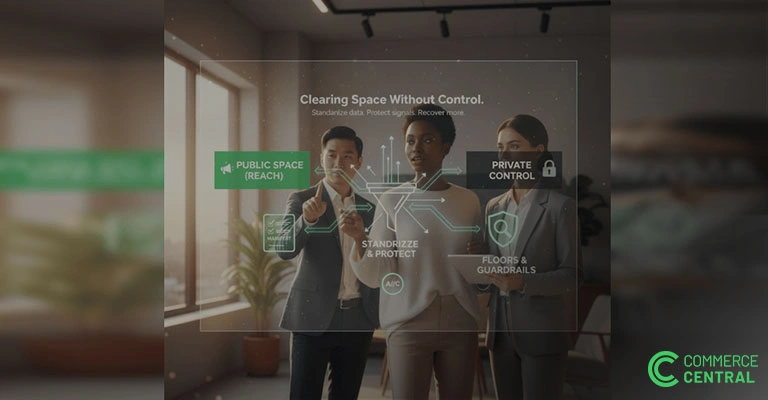

Clearing Space Without Compromise

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

How Stale Inventory Eats Margin, Disrupts Ops, and Damages Brand Momentum

In the apparel business, timing is more than a supply chain concern — it’s a brand imperative. When clothes don’t move, they don’t just sit; they spoil in relevance. A spring collection that doesn’t sell by summer often becomes a markdown liability. By fall, it’s dead stock.

Unlike durable goods, apparel faces a constant tension between seasonality, trend cycles, and consumer expectations. Inventory needs to flow. When it stalls, the impact isn’t just financial — it clogs operations, pressures teams, and weakens customer perception.

In this post, we’ll break down the true cost of slow-moving apparel inventory — using real industry benchmarks, operational insights, and guidance to help you audit your current offload strategy.

Clothes don’t spoil like yogurt, but in retail, they go stale just as fast.

According to McKinsey, 70% of fashion stock must be sold at full price within the first 6–8 weeks to preserve planned margins. After that window, markdowns kick in and each week that inventory lingers, margins erode.

Seasonal collections, trend-driven drops, and even evergreen basics are now affected by shorter consumer attention cycles. Slow inventory becomes harder to sell, forcing retailers to rely on price cuts or flash sales just to clear space.

Apparel is already a low-margin business for many brands. But once items miss their sell-through target, steep discounts are often the only way out.

A Bain study found that unsold apparel regularly costs brands 10–20% of seasonal revenue, depending on how much inventory goes to truckload liquidation or waste. That’s not just lost profit — that's the margin you paid to warehouse, hang, steam, and eventually give away.

Apparel logistics depend on turnover. Unlike furniture or electronics, garments are relatively low-cost per unit but high in handling needs. Returns are frequent, sizing and SKU complexity is high, and storage often requires careful organization.

When unsold apparel builds up:

It’s operational drag, not always visible in the P&L, but definitely felt on the floor.

The longer a fashion brand holds outdated stock, the more it risks hurting brand perception. Flashy markdowns, clearance racks, or outlet dumps dilute exclusivity especially for mid-market and premium brands trying to hold pricing power.

Worse, if the same inventory ends up in off-price or resale channels with no control, customers start to expect discounts by default. Your “$98 dress” becomes the “$28 item I saw at the outlet last week.”

In one survey by First Insight, over 60% of consumers said seeing frequent markdowns makes them question a brand’s quality and value.

No one wants to keep promoting a product that isn’t moving.

From sales associates trying to style last season’s pieces to warehouse teams re-boxing unsold returns, morale takes a hit when energy is spent managing mistakes instead of building momentum. It’s hard to sell a story of newness when you’re still buried in last season’s backlog.

To get ahead of slow inventory drag, start by asking:

In apparel, aging inventory isn’t just slow-moving stock — it’s a sign that your system is out of sync with the market. Fast-changing trends and tight margins leave little room for error. To protect both profitability and brand relevance, your offload strategy needs to move as quickly as your designs do.

Ready to make sure your inventory isn’t holding you back? Visit www.commercecentral.io to explore smarter offload infrastructure.

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Avoid audit headaches and compliance risks by properly documenting and tracking inventory offloads, keeping finance and legal teams confident.

Don’t let outdated returns processes slow you down. Discover how reCommerce can digitize the last link of your supply chain and drive efficiency.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.