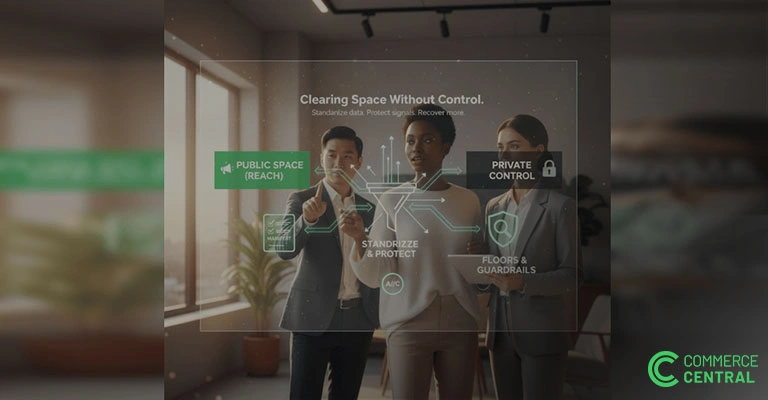

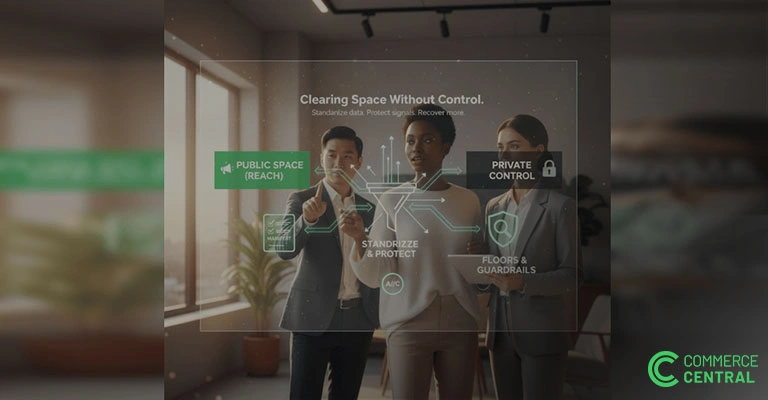

Clearing Space Without Compromise

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Modern supply chains have undergone a digital revolution, except at the very end. Companies boast automated factories and AI-driven logistics, yet many still handle returns and excess inventory with decades-old methods. It's a jarring disconnect: the average supply chain is only 43% digitized, making it the least digitized business area according to McKinsey. In fact, a mere 2% of supply chain executives even focus on digital transformation in this arena. This means the “last link" - dealing with unsold; dealing with unsold, returned, or excess products – is often the weakest. A supply chain is only as strong as its weakest link, and for many organizations that link snaps right at the end.

If your reverse logistics and reCommerce processes still rely on ad-hoc liquidation deals, manual spreadsheets, or siloed teams, you're not alone – but you are falling behind. Legacy approaches to returns and liquidation create hidden drags on modern operations. Piles of returned merchandise sitting in warehouses tie up capital and space, undermining the efficiency gains of your high-tech distribution centers. Meanwhile, slow, manual disposition means missed opportunities: Retailers already liquidate over 95% of their overstock and returned items on secondary markets, yet often at dismal recovery values. Many firms recoup only 15-50% of an item's original value when they dump it via traditional liquidators or bulk sales. In other words, half or more of the product’s value vanishes due to outdated resale methods. This isn’t just a minor operational nuisance – it’s a direct hit to the bottom line and a brake on your otherwise modern supply chain.

Consider the Scale: U.S. consumers are projected to return $890 billion in merchandise in 2024 – about 17% of total retail sales. Every one of those products must go somewhere. If your solution is a fire sale for pennies on the dollar, you’re leaving heaps of money on the table. Paradoxically, companies obsess over cutting forward logistics costs by a few percentage points but ignore that a modest improvement in resale value can yield far greater gains. For example, reducing return handling costs by 10% might save only a few cents per item, but increasing the recovery rate by 10% can boost profit by $0.30 to $1 per unit. For a retailer processing millions of returns, that translates to millions of dollars in reclaimed revenue. The message is clear: outdated reCommerce processes aren’t just inconvenient – they’re actively undermining your modernization efforts and profitability.

To integrate reCommerce into your operations stack, it helps to envision a maturity model. Where do you stand today, and what does “modern” look like? Here’s a three-tier maturity model for resale and liquidation:

Adopting a Tier 3 approach might sound ambitious, but it’s increasingly within reach – and the payoff is tangible. Digital transformation doesn’t stop at the customer’s purchase; it extends through the product’s entire lifecycle. Leaders in supply chain digitization are already reaping rewards, from lower costs to higher margins. By bringing returns and resale into the fold, you join this elite group and align with broader modernization goals of agility, efficiency, and sustainability.

Here are concrete steps to start strengthening your reCommerce capabilities:

Embrace a Mindset Shift: Finally, success in modern reCommerce is as much about culture as technology. Leadership should champion the idea that reCommerce is a strategic extension of the supply chain, not a scrappy backroom activity. Set KPIs for value recovery, velocity of resale, and even customer experience of returns. Celebrate wins – every dollar recovered from liquidation or every week cut from the returns cycle is a boost to your bottom line and your sustainability metrics. When teams see that resale and liquidation performance is being measured and improved, they’ll

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Avoid audit headaches and compliance risks by properly documenting and tracking inventory offloads, keeping finance and legal teams confident.

Find out how unsold furniture affects storage costs, team morale, and sales performance, and how to fix it before it hits your bottom line.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.