Why Smart Buyers Vet Sellers Instead of Chasing Deals

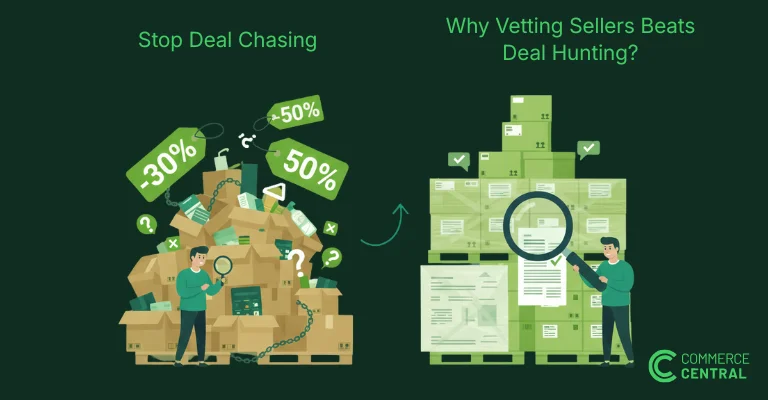

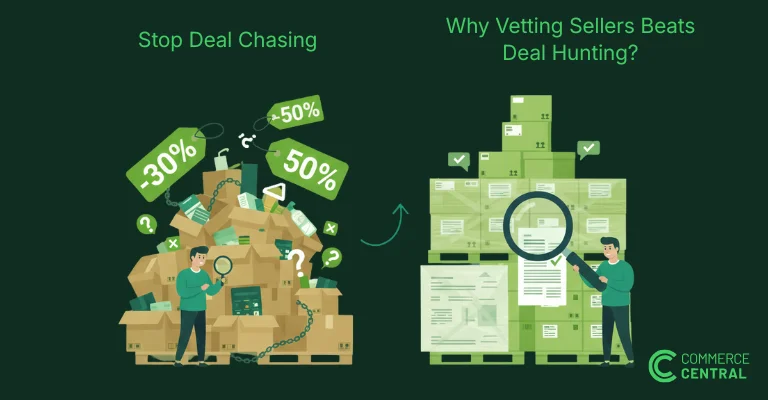

Learn why successful buyers stop chasing cheap deals and start vetting sellers in liquidation auctions online. Build better sourcing rhythm with trusted partners.

Understanding how liquidation works starts with knowing the key players—from the brands producing the goods to the resellers flipping them for profit. Whether you’re sourcing for a dollar store, bin store, or eBay operation, you’ll navigate a web of players. Here’s how it all fits together.

Each step adds a layer of sorting, markup, or access — and understanding each role helps you source smarter.

Sometimes excess goods originate from the factory floor: canceled orders, packaging errors, or surplus production. While most goods enter wholesale liquidation after retail, some manufacturers do liquidate directly typically via brokers or large liquidators. This inventory is often new, but may lack retail packaging.

Big-box stores and e-commerce players generate massive liquidation supply. Returns, shelf pulls, and overstocks pile up fast. Rather than sort these manually, most retailers opt to offload them in bulk truckloads. Think Walmart, Target, Amazon — they sell mixed loads to recover warehouse space and capital.

Commerce Central sources inventory directly from major retailers, so buyers can access reliable truckloads with clear retailer attribution.

These are wholesale giants with retailer contracts. They buy entire truckloads blind, sort and grade the goods, then break them into pallets or cases for resale. They might charge more per pallet, but they often provide manifests and offer better condition control, and even specialize in Liquidation Deals in Home Goods for targeted sourcing.

Commerce Central partners with select large liquidators to give resellers access to professionally sorted, condition-graded inventory with transparent pricing.

Brokers don’t always own the product. They resell on behalf of others, sometimes offering access to hard-to-find loads, but also marking up heavily. Quality varies: some are trustworthy, others inflate prices or resell junk. Always ask: where is the product stored? Who’s fulfilling it?

Commerce Central removes that guesswork by listing verified sellers only — no middlemen brokers, no surprise re-routing.

These platforms aggregate inventory from multiple sellers. Some are run by retailers themselves (e.g. Amazon Liquidation), others are independent (like B-Stock or Liquidation.com). They bring visibility, reviews, and returns auctions but buyers still must vet each seller.

Commerce Central is designed to combine the ease of a marketplace with the trust of a curated network with fewer sellers, better oversight, more support.

At the end of the chain are people like you: discount store owners, Amazon FBA sellers, flea market flippers. This is where product gets priced, prepped, and sold to the public. Each reseller model benefits from different types of loads, so understanding the upstream flow helps you source the right way.

Commerce Central helps you:

Whether you’re new to liquidation or scaling your resale business, knowing the chain is step one and having the right guide changes the game.

Explore verified liquidation inventory now at www.commercecentral.io

What is the liquidation supply chain?It’s the flow of excess goods from retailers and brands to liquidators, brokers, and finally resellers. It includes returns, shelf pulls, and overstock being resold instead of thrown away.

Who are the key players in liquidation?Manufacturers, retailers, large liquidators, brokers, online marketplaces, and resellers (like discount store owners or online sellers).

Is it better to buy from a liquidator or a broker?Generally, buying from direct liquidators or verified marketplaces like Commerce Central reduces markup and risk. Brokers can add value, but they can also inflate prices.

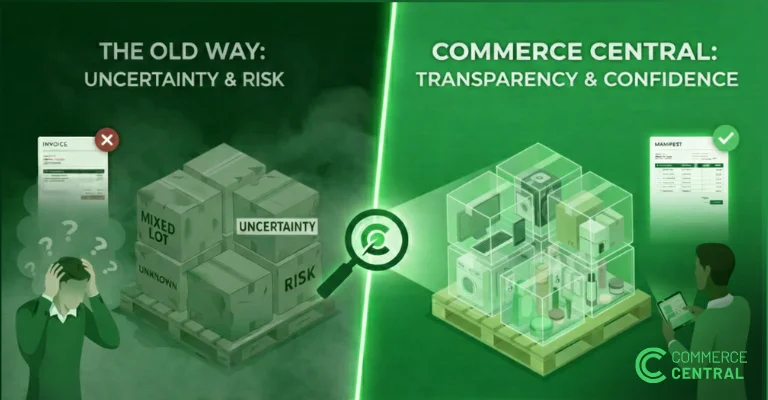

How can I avoid scams or bad pallets?Look for manifests, understand condition codes, research the seller, and start small. Commerce Central vets sellers and provides upfront pricing and transparency.

Learn why successful buyers stop chasing cheap deals and start vetting sellers in liquidation auctions online. Build better sourcing rhythm with trusted partners.

Learn how to resell beauty returns without hurting your reputation. Understand returns auctions, condition grading, and why transparency matters when sourcing resale-ready inventory.

Learn why transparency is critical in pallet liquidation sales and liquidation auctions. Discover how clear manifests help buyers avoid losses and source with confidence.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.