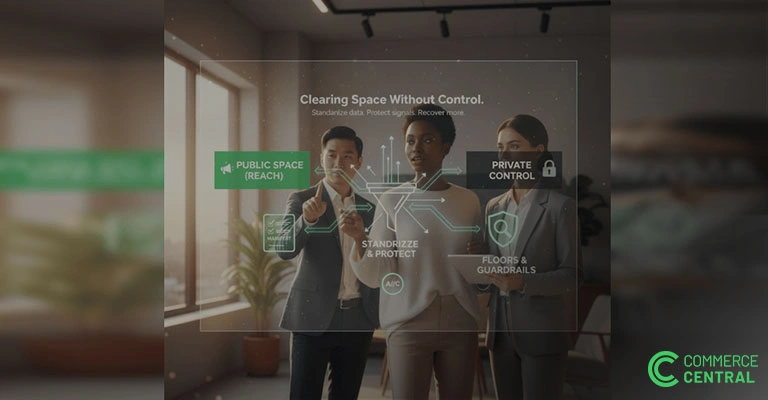

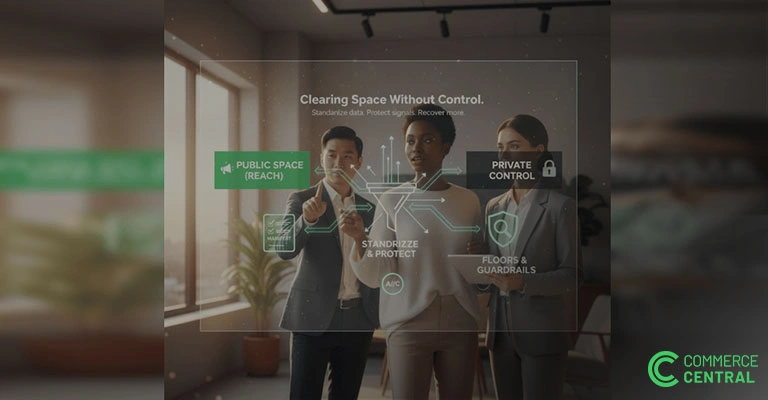

Clearing Space Without Compromise

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Imagine this: It’s audit season and your CFO is asked to prove what happened to last year’s unsold stock. Suddenly, there’s a scramble – pallets of “liquidated” inventory have vanished from the records. No clear paper trail, no signed approvals, no backup documentation. This isn’t a nightmare scenario – it’s a common reality in retail offloading of excess or returned products. In one case, an internal audit found that unsold items from an auction were literally thrown away without any management approval or record, due to the lack of tracking procedures. The result? A giant question mark in the books and a serious compliance headache. Without proper records, you could even lose tax deductions on destroyed stock – the IRS may simply disallow your write-off if you can’t prove the inventory was disposed of as claimed. It’s clear that poor offload documentation isn’t just an operational oversight; it’s a ticking time bomb for legal and finance teams.

Most retailers excel at selling products, not at documenting their unselling. When it comes to offloading surplus via resale, liquidation, or disposal, many organizations still operate on ad-hoc spreadsheets and blind trust. Reverse logistics has historically been “one of the least focused areas” for companies, which means critical record-keeping often falls through the cracks. Consider a recent audit of a retailer’s liquidation process: auditors discovered there was no central inventory list of items sent to the clearance warehouse and no reconciliation between what was shipped out and what was actually sold off. In other words, no one could say for sure what should still be in that warehouse or what revenue was recovered. The same audit flagged that there were zero disposition records for leftover stock – unsold goods weren’t tracked if they were re-auctioned, repurposed, or simply discarded. One item had even been auctioned twice with no buyer and then tossed in the garbage with nobody accountable. These gaps are exactly what keep legal and finance executives up at night. Lack of an audit trail makes it “not possible to determine” where inventory went, opening the door for misreported finances or even asset misappropriation.

Why does this happen so often? For one, teams responsible for markdowns and liquidation are focused on moving product out, as fast as possible, to free up space. Documentation can feel like a luxury when you’re racing seasonal deadlines or trying to recoup pennies on the dollar. Additionally, third-party liquidators or brokers might not automatically provide detailed reports, especially if the retailer didn’t insist on them. The result is a black hole in the records – one that auditors will probe eventually. And the stakes are high: missing or messy documentation can paint an inaccurate financial picture and invite regulatory scrutiny. In short, poor resale record-keeping isn’t just a nuisance; it’s a serious compliance risk hiding in plain sight.

From the perspective of your company’s legal counsel and finance department, offloading inventory should follow the same rigor as any other financial transaction. These stakeholders expect audit-ready documentation for every batch of product that leaves through secondary channels. In practice, that means maintaining a comprehensive inventory disposal log tracking all the key details: item descriptions, quantities, dates, how the items were offloaded (resale, donation, destruction, etc.), and to whom. Ideally, each entry is backed by supporting documents – the bill of sale from the liquidator, a donation receipt, or a certificate of destruction – to serve as hard evidence of the disposition. Legal and finance teams assume this information is being captured, but too often it isn’t.

What do they want these records for? First, financial accuracy. Finance leaders need to ensure that every unit leaving inventory is properly accounted for – either as revenue (if sold) or as a write-down loss. They’re on the hook to align these offload adjustments with the financial statements and justify them to auditors. If hundreds of thousands of dollars in inventory vanish from the balance sheet with no backup, auditors will raise flags and may even force a restatement of earnings. In fact, regulators like the IRS and SEC require businesses to retain detailed inventory disposition records for several years (often 3–7 years), and failing to do so can lead to penalties, disallowed tax deductions, or even financial restatements. Public companies have the added pressure of Sarbanes-Oxley (SOX) compliance, which mandates strong internal controls over financial reporting – including how you track and approve inventory write-offs and disposals. In other words, the CFO signing off on your books is implicitly assuring that there’s a reliable paper trail for all those offloaded goods.

Legal executives, for their part, are looking at risk and governance. They expect that the offloading process doesn’t open the company to liabilities or regulatory violations. For example, if products are liquidated internationally to avoid channel conflict, the legal team likely requires proof (say, a Bill of Lading or export paperwork) that the goods indeed left the domestic market. Many leading retailers now bake this into contracts – buyers must adhere to resale terms and provide evidence, like proof of export or proper disposal, to ensure compliance with company policies. Legal also wants assurance that any sensitive or regulated items (electronics with data, hazardous materials, etc.) were disposed of in compliance with laws and that all necessary approvals were obtained. At the end of the day, both Legal and Finance are expecting a controlled, transparent offload process where nothing just “disappears” unaccounted. Unfortunately, what they rarely get is that level of rigor – unless the organization has made a conscious effort to audit-proof its offloading.

Neglecting resale and liquidation documentation isn’t just a minor process gap; it’s a recipe for downstream governance disasters. What’s the worst that could happen? For starters, your company could face a painful external audit or investigation. Without an audit trail, you might struggle to prove that a large write-down of inventory was legitimate. Tax authorities have little patience for missing paperwork – if you can’t substantiate the loss or donation of inventory, they can deny your deductions and hit you with back taxes and fines. Regulatory bodies and even investors see missing records as a red flag: one advisory warns that regulators may impose fines or legal action if your documentation doesn’t meet required standards. In extreme cases, lack of oversight can mask fraud or theft – imagine an employee “offloading” high-value items to a fake recycler and pocketing the goods, all because there was no system forcing proper documentation or approvals. This isn’t far-fetched; weak controls have led to assets being misappropriated under the guise of disposal in the past.

There’s also a reputation and operational angle. If offloaded products aren’t tracked, a company might unknowingly violate agreements – for example, premium brands finding their unsold merchandise resold in forbidden channels, undermining brand image. Or consider product safety: if a batch of offloaded goods later faces a safety recall, will you be able to trace who bought them or where they ended up? Poor records make it nearly impossible to notify downstream parties or contain the issue, exposing the company to legal liability and public embarrassment. Even internally, when legal or finance come asking questions about a past offload, nothing erodes their confidence faster than blank stares or frantic email searches for a missing spreadsheet. It signals a breakdown in governance. Conversely, having a solid audit trail for inventory dispositions instills confidence and discipline across the organization – it shows that nothing falls through the cracks. That confidence can be crucial when leadership is making decisions or certifying reports; reliable information is the bedrock of good governance and decision-making.

The good news is that closing these documentation gaps is entirely achievable – it just requires a proactive approach and the right processes. Here are concrete steps to take to ensure your next offload is audit-proof:

Create a single source of truth to record every inventory disposition. This could be a module in your inventory management system or even a well-structured database or spreadsheet. The log must capture key information for each offload event, including what was removed, when, how, and who approved it. If you’re disposing of inventory in batches, log each batch with a unique identifier or reference number. For example:

|

Date |

Item/Batch ID |

Description |

Quantity |

Disposition Method |

Buyer/Recipient |

Value or Proceeds |

Approved By |

Documentation Reference |

|

2025-06-30 |

Batch #A123 |

Winter jackets (assorted sizes) |

500 |

Resale – Liquidator Auction |

XYZ Liquidators Inc. |

$25,000 |

J. Smith (Finance) |

Invoice #98765; Contract on file |

|

2025-06-30 |

SKU 448877 |

Bluetooth Headphones Model X |

120 |

Destruction (E-waste) |

N/A (Scrapped) |

$0 (Written off) |

A. Lee (Ops) |

Destruction Cert #EW-2025-45 |

Sample Audit-Ready Offload Log – each entry tracks the item(s), how they were offloaded, who approved, and links to proof. Every line in this log should tell a complete story at a glance. Legal and finance should be able to pick any entry and find the supporting documents instantly. In fact, supporting files (scanned receipts, certificates, etc.) can be stored digitally and referenced by a document ID in the log. This way, if an auditor asks “prove these 120 headphones were indeed scrapped and not sold under the table,” you can produce the e-waste destruction certificate on demand.

Don’t wait for an audit to enforce discipline. Develop a formal offloading procedure that spells out how decisions are made and documented. For instance, require a manager’s or controller’s sign-off before inventory is offloaded, not after the fact. One organization addressed its gaps by implementing a standardized “Authority to Dispose” form and approval workflow – nothing could be scrapped or sold without a manager’s e-signature. The procedure should also cover “edge cases” like unsold auction leftovers: as a policy, no product exits the company (even to the dumpster) without a record and authorization. By setting these rules, you create accountability. Every team member knows that if they offload inventory, they are responsible for updating the log and securing approvals.

Connect the offload logging with your accounting. When you remove items from inventory for liquidation or disposal, there should be a corresponding entry in the financial books (e.g. an inventory write-off, or sale income). Tying the two together serves as a natural audit check – the quantities and values in your offload log should reconcile with adjustments in your inventory asset account or Cost of Goods Sold. Some modern inventory systems help with this by providing a built-in audit trail that links each returned or disposed item to its financial impact. If possible, automate the updates: for example, when a warehouse clerk records a batch as “shipped to liquidator” in the system, it could automatically generate accounting entries and a placeholder in the offload log. Even if full automation isn’t feasible, set a routine for finance to review the offload log monthly or quarterly and cross-verify it against financial records. This catches any discrepancies early, long before an external audit would.

An audit-proof process means no surprises. Perform regular reconciliations between your physical inventory, the offload log, and financial records. If 1,000 units were slated for liquidation last quarter, can you account for all 1,000 (sold, scrapped or in transit)? If not, find out why and document it. Internal auditors or inventory control staff can periodically sample the offload records to ensure everything matches up. In one audit, simply reconciling the forms used for surplus shipments against what was actually sold was a recommended fix to catch unaccounted items. Building in these checks – say, a quarterly internal “resale audit compliance” review – will strengthen your records and instill discipline. Treat your offload log with the same seriousness as a cash ledger; after all, inventory is money.

Finally, ensure that all these documents and logs are stored securely and retained for the required period. Follow the “keep everything” principle (within reason) when it comes to offload documentation. Tax and audit regulations typically demand keeping inventory and disposal records for several years. Store them in a searchable, backed-up repository. This could be a document management system or even a well-organized shared drive, as long as access is controlled and files are not at risk of inadvertent deletion. Consider using cloud backups or a records management service for extra protection – you don’t want a server crash or accidental purge to wipe out your only proof of a major inventory disposal from two years ago. Good record-keeping is not just about compliance, but also about efficiency: it means when Legal or Finance comes asking, you can retrieve the needed info in minutes, not days.

By taking these steps, you transform offloading from a murky, handshake-driven affair into a transparent, well-governed process. Not only will you protect against downstream risks, you might even uncover hidden value. (For example, our team found that when clients started logging their offloads diligently, they identified high-value items inadvertently marked for scrap and pulled them back for resale – essentially free money recovered, thanks to better visibility.)

The big takeaway is a shift in perspective: inventory offloading isn’t just a back-room cleanup task – it’s part of your financial and compliance landscape. Treating it with rigor and creating an audit-proof trail is like an insurance policy for your company’s balance sheet and reputation. Yes, it requires effort and some cultural change. But the alternative is waking up to an audit nightmare or a costly “governance surprise” that could have been avoided.

By audit-proofing the offload, you assure your legal and finance leaders (and by extension, your board and regulators) that nothing is slipping through the cracks. Every piece of merchandise that leaves your premises has a story documented – the who, what, when, where, and why accounted for. This level of transparency not only shields you from penalties and embarrassing mistakes, but it also fosters better decision-making. Executives can confidently answer questions like “How much did we recover from last quarter’s liquidation, and were there any compliance issues?” with hard data in hand.

In an era where $740 billion in excess goods flooded retailers in 2023 alone, requiring massive liquidation efforts, having robust offload documentation is more important than ever. It turns a traditionally weak link into a strength. Instead of dreading audits, you’ll breeze through them with a well-organized trail of records. Instead of legal and finance “rarely getting” the visibility they expect, you’ll be delivering it consistently. And that sets you apart as a truly mature, trustworthy operation. The bottom line: audit-proofing your offload process isn’t overhead – it’s smart governance. It protects your profits and your credibility, ensuring that when it comes to inventory disposition, nothing gets lost in the shuffle.

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Don’t let outdated returns processes slow you down. Discover how reCommerce can digitize the last link of your supply chain and drive efficiency.

Find out how unsold furniture affects storage costs, team morale, and sales performance, and how to fix it before it hits your bottom line.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.