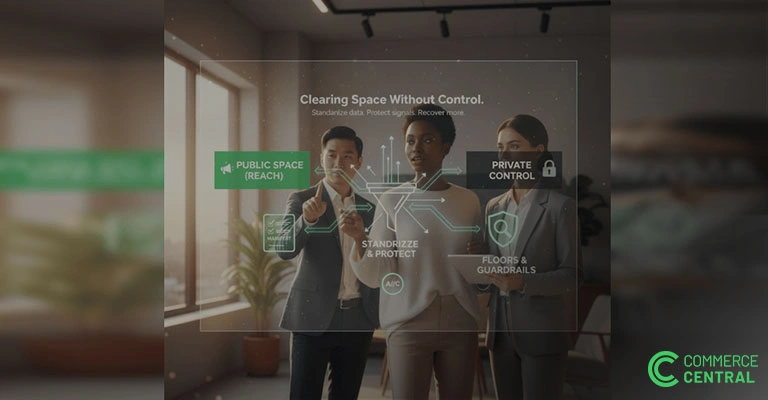

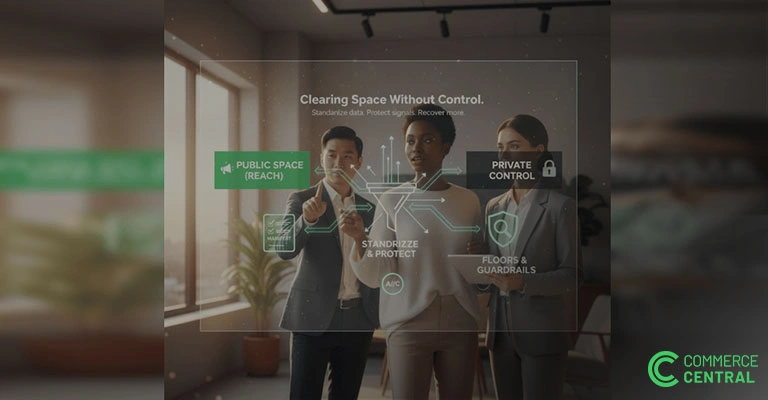

Clearing Space Without Compromise

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

How Overstocked Furniture Eats Into Space, Cash, and Team Morale And What To Do About It

Furniture doesn’t just sit, it sprawls. When slow-moving SKUs in this category start piling up, they don’t just strain your margins. They consume square footage, inflate storage costs, jam up operations, and wear down morale.

Whether you're a furniture brand, a home goods retailer, or a regional chain juggling seasonal resets, the stakes are clear: you can't afford to let unsold bulk clog your flow.

In this article, we break down the operational and financial drag of excess furniture inventory, and offer a smarter way to stay ahead of the backlog.

A $500 sofa that doesn’t sell for 3–4 months might lose more value in rent than in markdowns. Why? Because furniture carries a low value-to-volume ratio. The bigger the item, the more it costs just to sit.

Let’s do the math:

Multiply that across hundreds or thousands of SKUs, and you’re looking at tens of thousands in sunk storage expense before a single unit is discounted.

“We had entire sections of the warehouse full of oversized items that weren’t moving. The rent on that alone wiped out our Q1 margin,” shared one mid-market furniture retailer.

Furniture warehouses work best at 75–80% capacity. Above that, productivity tanks.

Why?

One distribution lead told us:

“The hardest part wasn’t the excess. It was how much labor we spent just working around it. It turned into a daily obstacle course.”

Furniture retailers know the drill: when product doesn’t move, cut prices dramatically. 50–70% off isn’t an exception, it’s the norm.

In 2023, Grand Home Furnishings ran steep outlet events to clear inventory fast. But for every $1,000 dining set sold at $400, the question remains: how much was lost on storage, discounting, and labor before the markdown even hit?

The problem isn’t the need to discount, it’s the delay in doing it.

Miss the window on patio furniture season? You may sit on it (literally and figuratively) for another 8 months. Wait too long on trend-sensitive items? Color palettes and fabrics go out of style, and suddenly that high-end sectional becomes clearance baggage.

These seasonal or aesthetic mismatches create a write-down loop where yesterday’s bestsellers become tomorrow’s liabilities.

Slow inventory doesn’t just wear down margins. It wears down your team.

Sales staff lose energy when pitching dusty floor models no one wants. Warehouse crews grow frustrated moving heavy items they know are headed for wholesale liquidation. Operations teams spend more time reacting to space issues than planning for growth.

And all of this distracts from launching new product lines, training staff, or improving service.

The most efficient furniture operators are flipping the script. Instead of reacting when showrooms or DCs are full, they’re building proactive offload systems that route slow movers before they become a crisis.

Here’s what it looks like:

Use internal metrics to flag when a product’s size-to-margin ratio is dragging down profitability.

Preemptively route items like patio sets, holiday collections, or past-season colors before they go out of style.

Commerce Central connects brands with vetted resellers who can move bulky items quickly with restrictions, buyer filters, and support that protects brand equity.

Reclaim floor and warehouse space, reduce markdown delays, and give your sales team a clean stage for new collections.

Use our Furniture Storage Burden Calculator to estimate your current carrying cost across slow-moving SKUs.

Or download our Clean Exit Playbook for Furniture Teams, a step-by-step toolkit for identifying, routing, and monetizing excess before it chips away at cash flow.

In the furniture business, scale can’t come at the cost of gridlock. If your inventory isn’t moving, it’s not just taking up space, it’s taking away margin, focus, and time.

Leaders who stay ahead of the offload curve don’t just recover better. They build faster.

Because every square foot filled with last season’s product is one you can’t use to sell what’s next.

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Avoid audit headaches and compliance risks by properly documenting and tracking inventory offloads, keeping finance and legal teams confident.

Don’t let outdated returns processes slow you down. Discover how reCommerce can digitize the last link of your supply chain and drive efficiency.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.