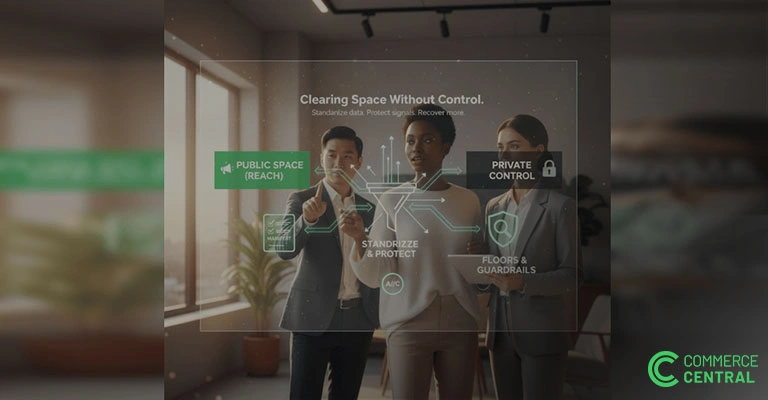

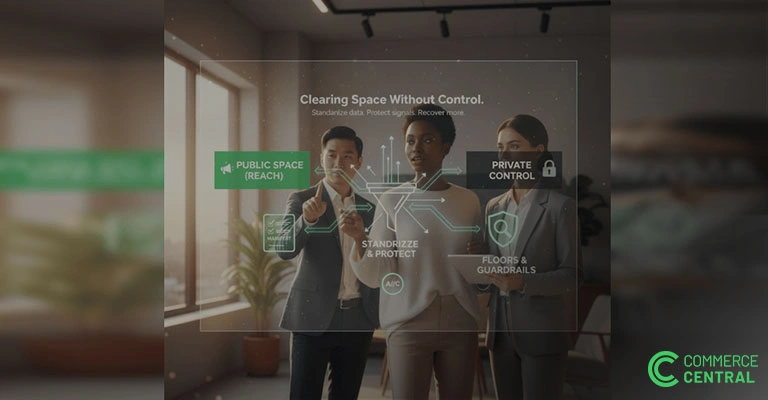

Clearing Space Without Compromise

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

How Expiry, Trend Cycles, and Brand Risk Turn Excess Stock Into a Liability

In the beauty and cosmetics industry, timing isn’t just important, it’s everything. Whether it’s a serum with a 24-month shelf life or a seasonal makeup palette that was all the rage on TikTok six weeks ago, inventory that doesn’t move fast enough becomes a problem faster than in nearly any other category.

The stakes are high: slow inventory in beauty doesn’t just eat up storage space. It expires. It loses relevance. It drains morale and bruises brand perception. And if left unmanaged, it can turn a top-performing SKU into a costly mistake.

In this article, we unpack the hidden cost of slow offloads in beauty and cosmetics, with data-backed insight into why so many brands underestimate the risk and what you can do to prevent it.

Most beauty products, especially skincare and clean formulations, come with hard expiration dates. When those dates pass, the products can’t be sold legally or ethically. That means 100% of that inventory becomes a write-off.

Industry research suggests more than 10% of beauty inventory never makes it to a saleable customer transaction. A report by Boop Beauty found the beauty sector leads CPG categories in inventory waste, losing 6.2% of stock annually to overproduction, expiration, or trend obsolescence. That’s higher than apparel (3.9%) or food (2.9%).

The cost isn’t just financial. Wasted inventory must be scrapped and many beauty products (e.g. pressurized aerosols, chemical-based formulas) require regulated disposal methods, adding cost to the damage already done.

Even if a product hasn’t technically expired, it may already be outdated.

Beauty is trend-driven. Think: new shade drops, seasonal packaging, TikTok virality. A lipstick that didn’t sell during its launch window may struggle to move months later not because it’s expired, but because the market has moved on.

In one audit, a national beauty retailer found 20–30% of its inventory was unsellable not due to spoilage, but because the products were “out of season.” If your product roadmap is always innovating, your backroom can’t afford to fall behind.

To move aged inventory, many beauty brands lean on:

But all of these cut the margin dramatically. More importantly, they dilute perceived brand value.

Luxury brands in particular face a painful trade-off: discount publicly and risk brand dilution, or discard stock entirely. In an infamous case, Burberry admitted to burning unsold beauty goods to avoid market devaluation, a practice now banned in several countries.

Beauty inventory isn’t just fragile, it’s logistically demanding. Extra handling for returns, inspections for expiration, rotation by batch all add cost.

But the human toll is real too. When stores are stuck clearing out last season’s gift sets, or DCs are packed with pallets of expiring product, it drags morale. It’s hard for sales, product, or ops teams to get excited about innovation when they’re still digging out of past mistakes.

This kind of backlog also disrupts launches: new collections might be delayed if there's no space, no budget, or no bandwidth to push them cleanly into market.

To stay ahead, leading beauty brands are turning to offload diagnostics. Start with these questions:

By mapping your inventory lifecycle from shelf life to sell-through, you can spot which products need a faster exit plan.

Slow inventory in beauty isn’t just inefficient, it’s expensive, risky, and avoidable. With better forecasting, smarter offload channels, and systems that detect aging stock before it becomes dead stock, brands can protect their margins and move with market momentum, not behind it.

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Avoid audit headaches and compliance risks by properly documenting and tracking inventory offloads, keeping finance and legal teams confident.

Don’t let outdated returns processes slow you down. Discover how reCommerce can digitize the last link of your supply chain and drive efficiency.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.