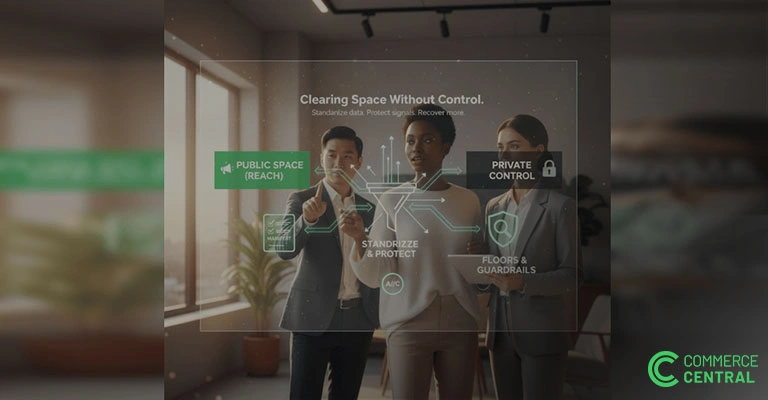

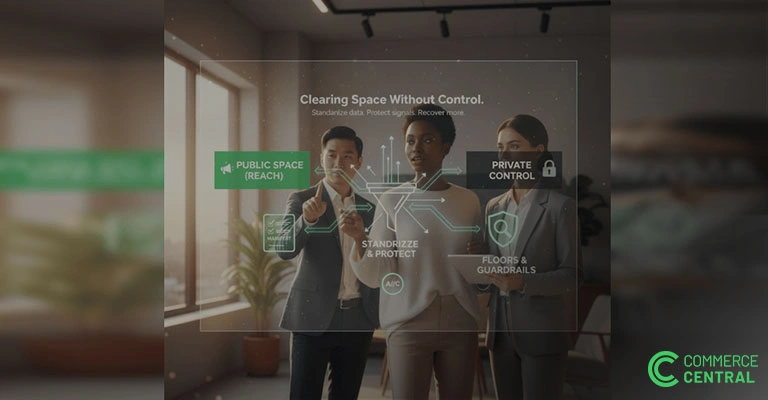

Clearing Space Without Compromise

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Why Aged Inventory Quietly Disrupts Ops, Drains Margin, and Pulls Teams Off Track

In the home goods category, inventory doesn’t just sit. It accumulates. It crowds racks, stalls resets, burns hours and slowly chips away at profit and momentum. Whether you’re holding appliances, bedding, decor, or seasonal SKUs, the real cost of aged inventory extends far beyond markdowns.

This article breaks down the operational and financial drag caused by slow inventory offloads and gives you a clear way to calculate the risk hiding inside your system.

Forecasts can be accurate. Merchandising can be tight. But one late shipment, one missed trend, or one demand shift and suddenly, you're staring at 80 liquidation pallets of product that no longer have a home.

For most mid-market home goods companies, 20–30% of inventory is aged or inactive. Once it crosses 60 days, it starts draining:

It also blocks your calendar. One ops lead said:

“We didn’t feel the cost until we delayed three inbound containers. That’s when we realized it wasn’t just a storage issue—it was a flow problem.”

Use this embedded 6-point diagnostic to evaluate your current exposure to inventory offload cost:

When you total these, you’ll uncover the true cost of stalled inventory. Not just in dollars, but in daily efficiency and team time.

The impact goes beyond metrics. When clearance becomes a cross-functional project, it drains time and morale. Ops teams chase legal sign-off. Brand fights over resale terms. Finance asks for cost recovery. What starts as a $30K inventory issue ends up consuming $300K in team hours across departments.

As one inventory director put it:

“We lost more time deciding what to do with dead stock than it took to plan two seasonal resets.”

Here’s how operationally strong home goods brands are improving offload velocity, without losing control:

To quantify your own exposure, use theHome Goods Offload Cost Estimator built into this framework. It calculates how much space, labor, and working capital are being absorbed by aged inventory right now.

Then, apply the Exit Checklist for Home Goods to help your ops team move stalled SKUs with clarity, control, and speed—without getting pulled into fire drills.

Slow offloads in home goods are more than a retail markdown issue. They’re an operational liability. Left unaddressed, they block warehouse flow, tie up cash, and steal hours from your most strategic teams. That’s why many brands are turning to structured liquidation deals in home goods to streamline exits without losing control over branding or margins.

In today’s margin environment, you don’t need more space. You need faster, cleaner exits.

Commerce Central was built for that. It helps home goods brands move verified inventory to trusted buyers without sacrificing brand controls or operational focus. Because when exits are clean, the whole system flows better.

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Avoid audit headaches and compliance risks by properly documenting and tracking inventory offloads, keeping finance and legal teams confident.

Don’t let outdated returns processes slow you down. Discover how reCommerce can digitize the last link of your supply chain and drive efficiency.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.