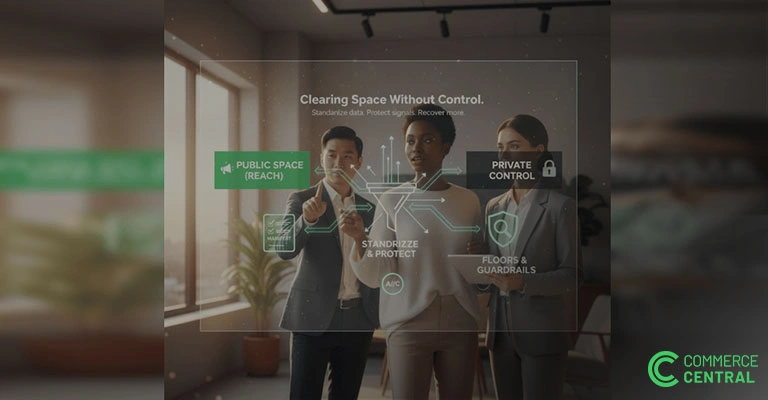

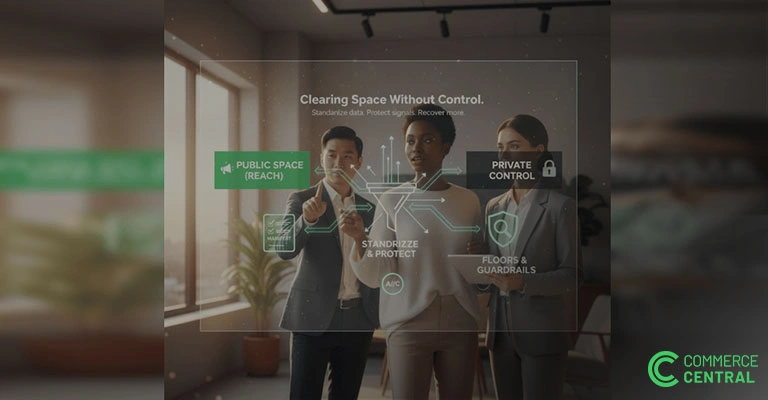

Clearing Space Without Compromise

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

In consumer packaged goods (CPG), time isn’t just money, it’s chemistry, capital, and coordination. From food and beverages to household items and personal care, inventory is designed to move fast. But when it doesn’t, the costs stack up and most brands underestimate just how much.

This article unpacks the true cost of slow-moving inventory in CPG. Not just the financial write-offs, but the operational drag, working capital lock, and morale impact that ripple across the business. It also highlights how upstream decisions like inventory buying play a role in long-term inventory health. You’ll also find a simple cost calculator and an offload planning checklist to help you diagnose the issue inside your own supply chain.

CPG inventory doesn’t just expire, it expires in place. That’s the issue.

When demand drops or forecasts overshoot, unsold goods clog warehouse racks, overflow cold storage, and delay resets. These aren’t just isolated hiccups. They ripple:

Even if the product is technically fine, its value drops every day it’s idle. The system slows and with it, so does your margin.

Industry data shows:

The cost of slow inventory in CPG is multidimensional:

As one VP of supply chain said:

“We spent more time trying to save near-expired stock than we did planning next quarter’s promotions. That’s when I knew something had to change.”

Use this 6-point diagnostic to estimate how much your aged inventory is really costing you:

|

Question |

What to Measure |

Impact |

|

1. Shelf Life Risk |

% of SKUs with <90 days shelf life × average unit cost |

Immediate write-off exposure |

|

2. Spoilage Write-offs |

$ value of expired/donated goods in last 90 days |

Historical waste trend |

|

3. Storage Cost Load |

Aged pallets × storage cost per pallet |

Monthly warehouse burn |

|

4. Capital Lock |

Value of SKUs with 45+ days no movement |

Cash tied up |

|

5. Labor Drag |

Weekly rehandling hours × avg hourly rate |

Hidden team costs |

|

6. Markdown Margin Loss |

Average discount on expiring goods × volume |

Lost revenue |

Add up those totals and you’ll have a clear sense of how slow inventory is quietly burning your margin, labor, and liquidity.

The smartest operators are no longer treating offloads as emergencies. They’re treating them as a strategic workflow, one as critical as forecasting or launch planning.

Here’s their checklist:

Flag SKUs approaching shelf life limits or stalled movement. Use a 45–60 day aging window, not quarterly surprises.

Set logic per brand, category, or product line:

Route aging product to secondary buyers or nonprofits before spoilage risk hits. Protect your brand while recovering value.

Move when velocity stalls — not when expiration looms. Let sales data drive action, not firefighting.

Align planning, ops, finance, and sales on one aging dashboard. Eliminate silos and speed decision-making.

Track time spent on inventory rework, disposal, or discounting. Rising hours? It’s a red flag for burnout and system failure.

The longer your inventory sits, the more you pay. Not just in discounts or disposal, but in slowed operations, lost time, and delayed growth.

If your goal is velocity, then exit strategy matters as much as entry. The best CPG teams move inventory out with as much confidence as they move it in.

Want to get ahead of your own offload curve?

Use the cost calculator above to assess your risk and the checklist to start planning cleaner exits today.

Improve liquidation predictability with structured data, clear processes, and strong guardrails. Commerce Central delivers faster cycles and higher recovery.

Avoid audit headaches and compliance risks by properly documenting and tracking inventory offloads, keeping finance and legal teams confident.

Don’t let outdated returns processes slow you down. Discover how reCommerce can digitize the last link of your supply chain and drive efficiency.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.