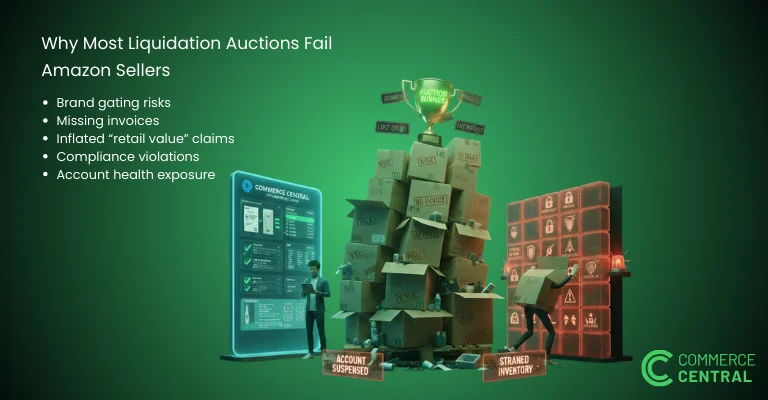

Why Most Liquidation Auctions Fail Amazon Sellers

Learn why most liquidation auctions fail Amazon sellers, the compliance and documentation risks involved, and how transparent sourcing alternatives reduce costly mistakes.

If sourcing isn’t done with attention to detail, reselling beauty items is among the fastest routes to losing the faith of shoppers.

With beauty stock, there’s an additional degree of inspection compared to things like appliances or household items: people buying want packaging to be undamaged, seals to be unbroken and to be sure the goods are safe to use. A single bad experience – a broken seal, something past its ‘best by’ date, or a product not as described – can completely destroy a seller’s good name.

Commerce Central addresses this directly by handling beauty returns as a group where the rules are more certain, what must be revealed is better set out, and doubt is simply not acceptable.

Slight defects may not matter in some product areas, but this isn’t the case in cosmetics.

When it’s about goods which are applied to skin, hair or the face, consumers have particular cleanliness expectations which they naturally expect.

This is a core reason why Commerce Central looks at beauty stock using things like whether seals are in place, how the packaging looks and checking the brand, all before any items are put up for sale.

This dedication to openness does away with the need for customers to ‘check and trust’ once the parcel arrives.

Prior to buying from any source, sellers need to know what return labels really mean and what they don’t.

Returns auctions get people in with price, however price on its own doesn’t protect a brand.

On returns auctions, it’s pretty typical to make use of condition labels in bulk, and these usually hide details which are important. Buyers ought to be ready to accept risk at this point: “work it out later”. That is probably all right for people who sell in large amounts, but isn’t good for making a brand last.

Commerce Central is, on purpose, going against this system by giving condition details before a purchase, not after the item arrives. In this situation, being open isn’t something you say in adverts; it’s a protection.

Not every product in the beauty section has the same amount of risk. Buyers who know what they are doing like to buy things where the state of the item and what people will expect is clear.

Things which are, in most cases, safe to re-sell:

The service puts up items for sale with these points in mind, so buyers aren’t put into groups which make the risks to their good names bigger.

Returns auctions usually get people in who are looking for a chance to make money, but a chance without being clear about things means people will be sorry.

Commerce Central’s sales of items go against this by showing the brand, state and readiness for the shelf at the very start. Before they spend any money, buyers know how the items fit in with the rules of their re-sale service, what their customers will expect, and where their brand is in the market.

This transparency-first strategy is an antidote to the vicious cycle of overbuying and underpricing that leads to customer complaints.

Short-term margins means little if the customers disappear after first purchase.

Commerce Central’s approach knows that sustainable resale businesses are based on repeat buyers, not one-off wins. By only listing sealed, shelf ready returns from verified brands, the platform shields buyers from inventory that may sell out fast but damage credibility.

This attitude distinguishes professional resellers from the quick-buck flippers.

In Commerce Central, we do not look to vague assurances or the optimistic branding of the product. Every beauty return form is designed to be clear and concise.

Buyers see:

By nurturing transparency in every listing, Commerce Central transforms beauty returns from a high-risk business into a managed sourcing channel.

Countless resellers enter into beauty sourcing for the margins and are shocked to learn that customer faith is harder to win than profit is to earn in the first place.

The transparency standards of Commerce Central are there for the simple fact that reputation damage is often invisible until it’s irreversible. Transparent disclosures allow purchasers to avoid inventory that can impact reviews, platform status, or customer loyalty.

In beauty resale, trust is the product.

Commerce Central proves that when sealed, shelf-ready returns from verified brands are clearly disclosed, buyers don’t have to choose between opportunity and integrity. They can scale responsibly without sacrificing reputation.

Are beauty returns safe to resell?

Yes, when products are sealed, shelf-ready, and clearly disclosed before purchase.

Why are returns auctions risky for beauty products?

Because vague condition labels can hide broken seals or unsellable inventory.

What beauty products resell best?

Sealed haircare, skincare tools, and verified brand personal care items.

How does Commerce Central reduce buyer risk?

By listing only sealed, shelf-ready returns with transparent condition details.

Why does transparency matter more in beauty resale?

Because customer trust is harder to rebuild than inventory is to replace.

Learn why most liquidation auctions fail Amazon sellers, the compliance and documentation risks involved, and how transparent sourcing alternatives reduce costly mistakes.

Stop guessing when buying liquidation pallets. Learn how professional buyers evaluate manifests, brand demand, and resale channels to avoid costly mistakes.

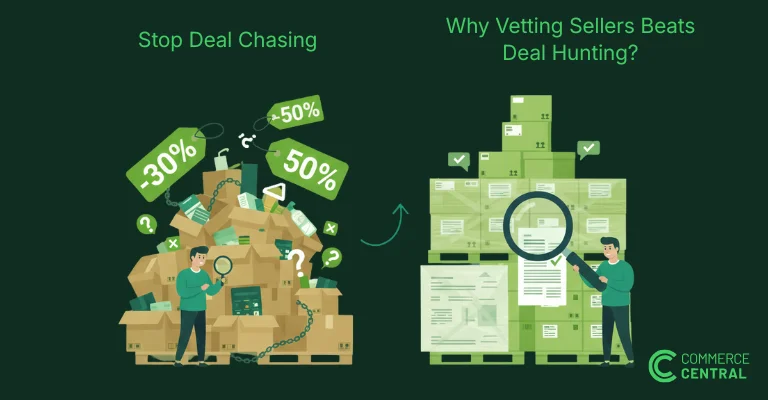

Learn why successful buyers stop chasing cheap deals and start vetting sellers in liquidation auctions online. Build better sourcing rhythm with trusted partners.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.