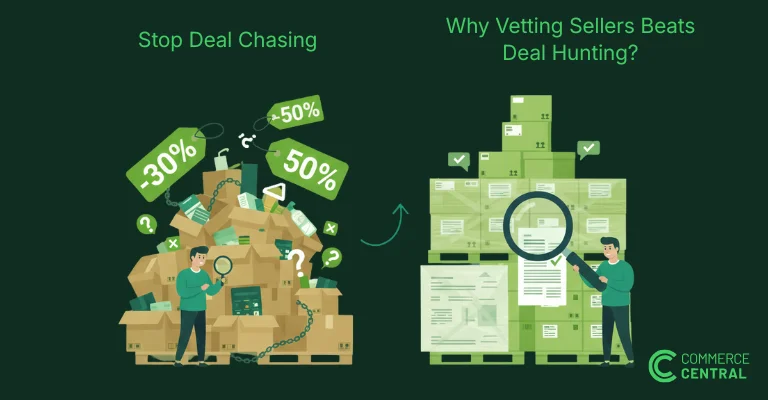

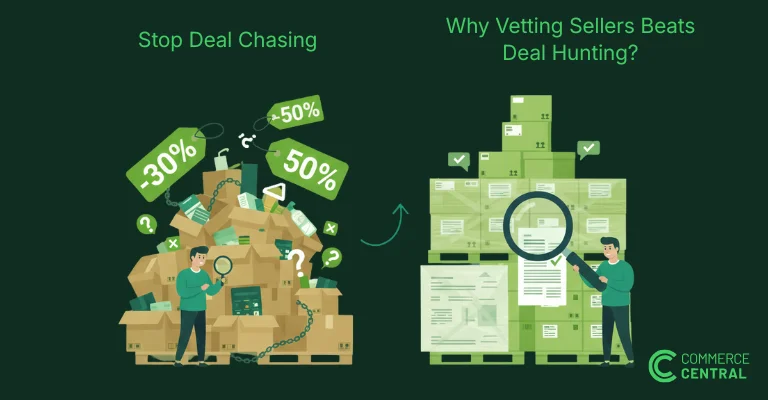

Why Smart Buyers Vet Sellers Instead of Chasing Deals

Learn why successful buyers stop chasing cheap deals and start vetting sellers in liquidation auctions online. Build better sourcing rhythm with trusted partners.

Beauty resale is one of the quickest ways to lose customer trust if sourcing isn’t treated carefully.

Unlike electronics or home goods, there’s an extra layer of scrutiny with beauty stock. Customers demand unbroken packaging, unbroken seals and the ability to trust that products are safe. One bad experience like a broken seal, an expired product, inconsistent condition can ruin a reseller’s reputation.

Commerce Central fixes this head-on by treating beauty returns as a category where regulations are more clear, disclosures are better defined and uncertainty is not an option.

Why Beauty Returns Require Stricter Evaluation

Minor flaws in some categories can be overlooked, but the same is not applicable in the beauty industry.

When it comes to products that get layered on skin, hair or face, there are certain hygiene expectations customers gravitate toward. That’s one of the reasons why Commerce Central views beauty inventory based on criteria like seal integrity, package condition and brand verification that all happen before listings ever go live.

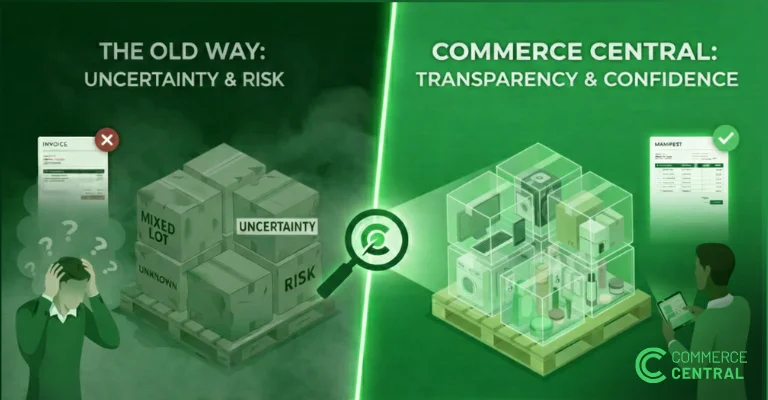

This focus on transparency, eliminates the need for buyers to “inspect and hope” upon delivery.

Before sourcing from any channel, buyers must understand what return labels actually mean and what they don’t.

Sealed returns are products that remain unopened, with intact manufacturer seals. These represent the lowest risk for resale and are the foundation of Commerce Central’s beauty inventory standards.

Shelf-pull returns typically refer to items removed from retail shelves, often due to overstock or resets. When properly disclosed, these can be resold confidently but only when shelf life and packaging condition are verified upfront.

Open-box returns are the most misunderstood. Even if a product appears unused, broken seals introduce risk that many resellers cannot afford. Commerce Central avoids ambiguity here by clearly separating shelf-ready inventory from anything that could compromise buyer trust.

Returns auctions lure buyers with pricing, but price alone doesn’t safeguard a brand.

On returns auctions, the use of bulk condition labels is rather common and often obscures such important details. Buyers should be prepared to take risk now: “figure it out later.” This may be possible for volume driven sellers, but it is not compatible with the long term building of a brand.

Commerce Central is intentionally challenging this model by providing clarity in the condition prior to a purchase, instead of after delivery. Transparency in this case isn’t a marketing

promise; it’s a safeguard.

Not all beauty category product has the same level of risk. Savvy buyers prefer to purchase items, which are inverifiable condition and customer expectations are well defined.

Items that are in most cases safe to resell:

The platform curates listings with these truths in mind, so that buyers are not boxed into categories that amplify risks to their reputations.

Returns auctions typically attract buyers in search of opportunity, but opportunity without clarity spells regret.

Commerce Central’s listings counter this by revealing brand, condition and shelf readiness up front. Before they spend any money, buyers understand how inventory fits within their resale platform’s rules, customers’ expectations and the market positioning of their brand.

This transparency-first strategy is an antidote to the vicious cycle of overbuying and underpricing that leads to customer complaints.

Short-term margins means little if the customers disappear after first purchase.

Commerce Central’s approach knows that sustainable resale businesses are based on repeat buyers, not one-off wins. By only listing sealed, shelf ready returns from verified brands, the platform shields buyers from inventory that may sell out fast but damage credibility.

This attitude distinguishes professional resellers from the quick-buck flippers.

In Commerce Central, we do not look to vague assurances or the optimistic branding of the product. Every beauty return form is designed to be clear and concise.

Buyers see:

By nurturing transparency in every listing, Commerce Central transforms beauty returns from a high-risk business into a managed sourcing channel.

Countless resellers enter into beauty sourcing for the margins and are shocked to learn that customer faith is harder to win than profit is to earn in the first place.

The transparency standards of Commerce Central are there for the simple fact that reputation damage is often invisible until it’s irreversible. Transparent disclosures allow purchasers to avoid inventory that can impact reviews, platform status, or customer loyalty.

In beauty resale, trust is the product.

Commerce Central proves that when sealed, shelf-ready returns from verified brands are clearly disclosed, buyers don’t have to choose between opportunity and integrity. They can scale responsibly without sacrificing reputation.

Are beauty returns safe to resell?

Yes, when products are sealed, shelf-ready, and clearly disclosed before purchase.

Why are returns auctions risky for beauty products?

Because vague condition labels can hide broken seals or unsellable inventory.

What beauty products resell best?

Sealed haircare, skincare tools, and verified brand personal care items.

How does Commerce Central reduce buyer risk?

By listing only sealed, shelf-ready returns with transparent condition details.

Why does transparency matter more in beauty resale?

Because customer trust is harder to rebuild than inventory is to replace.

Learn why successful buyers stop chasing cheap deals and start vetting sellers in liquidation auctions online. Build better sourcing rhythm with trusted partners.

Learn why transparency is critical in pallet liquidation sales and liquidation auctions. Discover how clear manifests help buyers avoid losses and source with confidence.

Discover what clean loads really mean in pallet liquidation sales. Learn how to identify shelf ready inventory, read manifests correctly, and avoid costly sourcing mistakes.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.