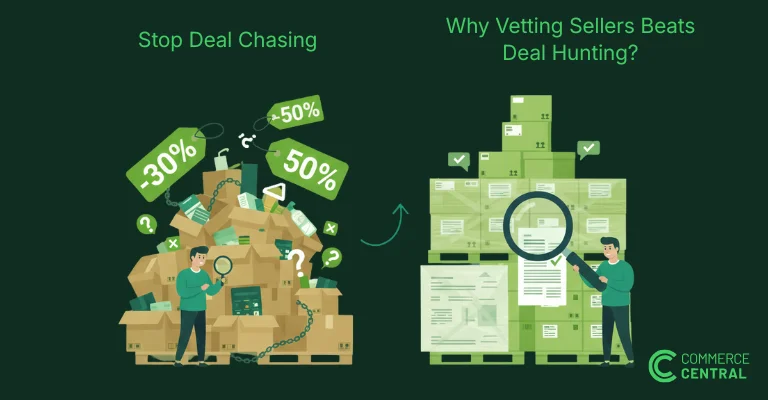

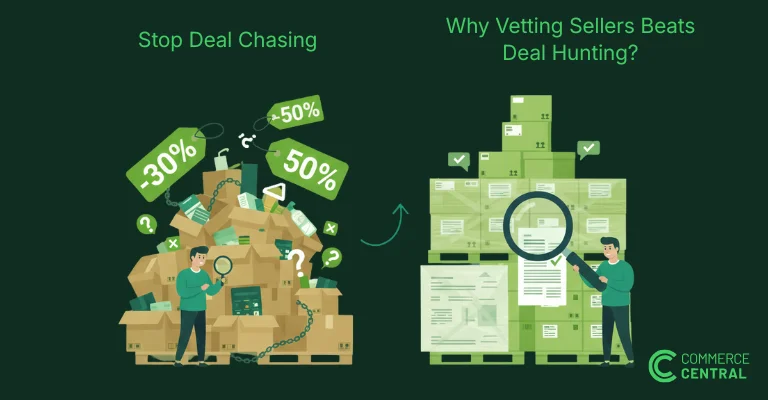

Why Smart Buyers Vet Sellers Instead of Chasing Deals

Learn why successful buyers stop chasing cheap deals and start vetting sellers in liquidation auctions online. Build better sourcing rhythm with trusted partners.

When searching to source deals, you might search on Google for things like pallets for sale or liquidation pallets for sale. Then you came across a best liquidation website offering open auctions where you can source inventory for a great price, but the only option is to bid, not to buy. You unknowingly enter the world of online open auctions, where deals move quickly, bidding wars, and the opportunity to make a lot of profit.

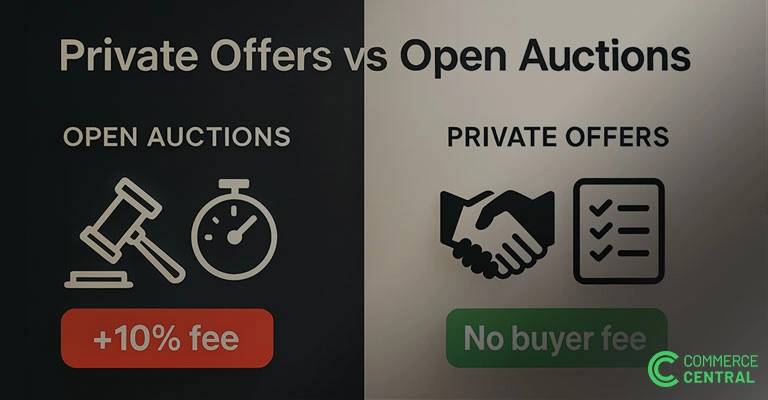

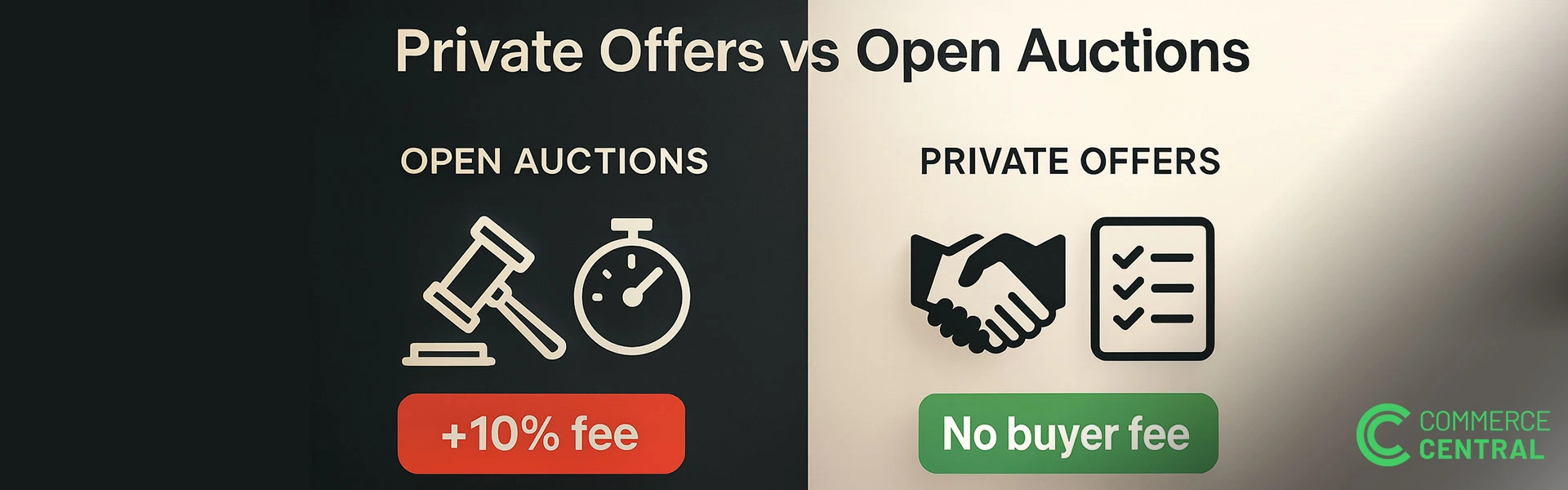

Open auctions are exactly what they sound like. There is a public listing where you can see the bidding price and an estimated MSRP, and people place their bids based on their willingness to pay. If someone jumps in near the end, the clock adds time. If you win the bid, your invoice will be the winning bid plus a buyer fee, shipping, and tax.

On B Stock, buyers are verified, and the clock can extend near the end of the auction. Many lots add a buyer's fee of around ten percent. Always read the lot page.

On Liquidation.com, the flow is similar. Buyer fees are often five to eleven percent, excluding shipping and tax. Payment is usually due within two business days.

Why buyers like auctions: You determine a real market price because of the number of people bidding. Public closing prices help you learn a new category. This can help you discover what hot items other buyers are interested in.

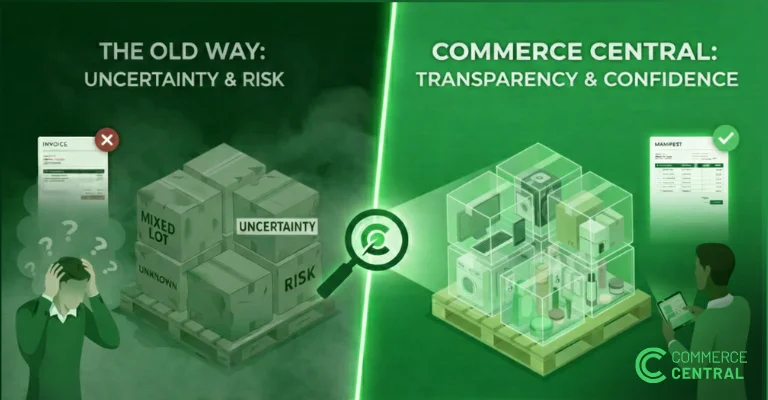

Where auctions get hard: The fees can really stack up, and a last-minute bidding war can cut into your margin. The lot might not always be manifested. It could be an unmanifested lot with a description of what the inventory contains, or vague condition notes. Payment and pickup windows move fast. Terms vary from lot to lot. And if you don't win the bid, it means more time spent watching, rebidding, and reconciling invoices.

Picture Monday morning. You spot a pallet of monitors and set a max bid. Five minutes before close, new bids appear, and the timer stretches. You really got into it because you know these are good items to resell. You win the bid. But then the invoice arrives. The buyer fee, shipping, and tax turned what was a good deal into a nightmare. You did not do anything wrong. This is simply how public auctions work.

A private offer is an invite-only deal to vetted buyers. The price is set up front. Terms are clear. No public bidding. No timer games.

Why does it often feel better? There is no buyer fee, so the price you see is the price you get. Manifests are tighter with required photos, which means fewer surprises when you receive them. Often, these Private offers can be recurring, so you can have a steady supply. Freight is easier to control because you can combine loads and keep a steady lane. Payment, pickup, and dispute windows are agreed in advance. Brands tend to place better lots with buyers who protect channels and pricing rules.

Auction path

Winning bid: 20,000 dollars

Buyer's fee is ten percent of 2,000 dollars.

Subtotal 22,000 dollars before shipping and tax

Freight 2,000 dollars

Accessorials 500 dollars

Total before tax: 24,500 dollars

Private path

Flat price with no buyer fee: 21,200 dollars

Consolidated freight: 1,600 dollars

Total before tax: 22,800 dollars

This is the best-case scenario, but sometimes you can find better auction deals and private offers that don't match the promised outcomes. You still need to do your due diligence as a buyer.

Start with the manifest. You want SKU or UPC, brand, unit amount, a fair comparable selling price, condition notes, and photos for each line.

Make the condition clear, if it says New in Original Packaging or if it is Used Liked - New.

Make sure you have a precise pallet amount and weight on the lot. This matters a lot when it comes to the final shipping cost.

Agree on deadlines and proof. Write down payment, pickup, and dispute windows and what counts as evidence for a claim, such as photos or serial numbers.

Make sure where you can sell the products. Are there limitations on marketplaces or regions? If found, breaking these could reduce your chance of future offers..

What should I check before accepting a private offer on Commerce Central?

All of the points above appear on the offer page. Do your due diligence, and if any of the information mentioned above is missing or unclear, reach out to the Commerce Central team.

You are testing a brand-new category. The product is very standard with little difference between conditions. The category has many active bidders, so results are efficient and transparent. A unique closeout pops up that you want to clear on the open market. You need inventory this week, and no private release fits the timing.

Pick a walk-away number that already includes the buyer's fee, likely freight, and tax. Read the entire listing and save the manifest and photos. Price a freight option before you bid so the math is real. If the number jumps past your walk-away line at the end, stop. The regret is almost always the lot you chased.

Get verified with basic business details, facilities, and where you sell. Be open about your channels and follow any limits on geography or platform. Offer steady take rates by committing to a baseline monthly volume with some flex by category. Report back when asked. Simple resale reporting builds trust and unlocks better lots.

Commerce Central routes private offers to vetted buyers. Depend on your need and what specific item you are sourcing for. You see clear condition tags, up-front freight estimates, and fewer exceptions after delivery. If you want a steadier supply with cleaner math, get verified and start receiving private offers.

Next step. Get verified to see private offers.

What should I check before accepting a private offer on Commerce Central?

All of the necessary information appears on the offer page. Do your due diligence, and if any of the information mentioned above is missing or unclear, reach out to the Commerce Central team.

When do open auctions still make sense if I use Commerce Central?

As mentioned above, otherwise, fee-free private offers with fixed terms usually net out cleaner and are easier to plan. Commerce Central has both models, so just pick the one that fit your needs.

How can a private offer lower my total cost

There usually are no buyer fees, but this can vary depending on the platform you are using. Since these are broken down by SKU level, you get a cleaner manifest because you can choose exactly what you want to buy, rather than dealing with a lot of junk along with a few good items. When you add those up, the cost often ends up below a similar auction result.

What is the actual difference between an open auction and a private offer?

Open auctions are public. The site bids for you up to your limit, and the clock can extend near the end. You pay the winning bid plus fees, shipping, and tax. Private offers are invite-only with a set price, clear terms, and no public bidding.

Learn why successful buyers stop chasing cheap deals and start vetting sellers in liquidation auctions online. Build better sourcing rhythm with trusted partners.

Learn how to resell beauty returns without hurting your reputation. Understand returns auctions, condition grading, and why transparency matters when sourcing resale-ready inventory.

Learn why transparency is critical in pallet liquidation sales and liquidation auctions. Discover how clear manifests help buyers avoid losses and source with confidence.

Join the only private surplus distribution platform built for trusted Buyers and Sellers.